Looking after your health gets harder as you age. The costs often rise, too. Planning early helps you meet needs later on when you retire.

The NHS gives free doctor visits, hospital stays, surgeries, tests and more. This takes good care of many basic health issues. But you might also want quicker private appointments, specialised treatments, extra therapies or home assistance. These help you live life to the fullest.

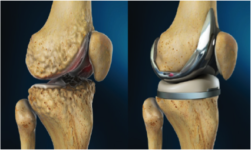

As people live longer, more retirees require complex care – dementia, daily nursing, rehab services, or devices like pacemakers or motorised chairs. These essential types of support ensure quality of life but have expenses that increase every year.

You consider future costs now before they become an emergency. Who will care for you at home if you get frail? Could you afford a good care facility? What private health options fit your budget? Make a long-term plan, saving bits from today’s funds and gaining security for tomorrow. You’ll feel more confident facing health changes knowing you prepared wisely ahead of time.

Private Health Insurance

Private health insurance costs money each month. The costs go up as you age. It is cheaper if you start when you are young. Key things to think about:

- Faster doctor and hospital visits. No long waits.

- More choice of specialists like knee or hip experts.

- Tests and scans more quickly.

- Better rooms if you stay in the hospital.

Private health insurance costs money each month. The costs go up as you age. It is cheaper if you start when young. Key things to think about:

- What is covered? Check for your health needs. Watch for limits on cancer or other big risks.

- Will it cover pre-existing conditions? Read the fine print.

- Are there age cut-offs on some cover types? Know when policies change.

- Will premiums go up a lot over time? Ask what others pay.

You can check what works for your budget and ask open insurance questions. You first read reviews online from those with covers. Then choose wisely for your needs.

Long-term Care Planning

Later in life, you may eventually need extra care. Knowing options for care homes, home help, or full-time nurses lets you prepare financially.

Care homes provide rooms, meals, washing, and medicine. Some have dementia wings. Others take just the physically frail. Quality, features and costs all vary greatly. Tour homes you like years before needing one.

Home care through local agencies sends helpers for bathing, rides, light housework and more. From a few hours a week to live-in care, services fit your changing abilities. The NHS may cover some costs based on health needs.

If assets are below £23,250 (excluding home), the council helps pay care bills. To qualify, submit bank statements and income docs. If you have savings, the council covers less.

A smaller personal loan can also assist in the short term. These loans of £1,000-5,000 from direct lenders allow fast access to funds in retirement at all credit levels. You lower your other debts first before taking on new lower-rate loans only as needed. You can apply for a 3,000 loan for bad credit from a direct lender. Some lenders give bad credit loans at low interest rates, so contact them.

Long-term care insurance pays out an income if one is ever unable to handle daily living activities alone. Make sure money is available for your choices regarding elderly care needs.

Saving through Health Savings Products

You can use special savings accounts to prepare for medical bills in retirement. These give tax benefits that grow your health fund faster.

Health ISAs work like normal ISAs. But they go just towards approved health products, services, or treatments. Interest and earnings are all tax-free. You can save up to a tax-free yearly allowance in the long run.

Pensions can also provide health cash:

- When you retire, many workplace or personal pensions let you take a tax-free lump sum. You often take 25% of the whole pot.

- This lump amount could partly pay for future medical costs—especially big things like dental implants, hearing aids, and surgeries.

- Invest pension funds while working. When older, withdraw tax-free to pay health bills.

Besides ISAs and pensions, some insurance policies have a savings element. Money paid but not yet used builds up a pool. This covers approved health costs in later years. Premiums paid today fund tomorrow’s expenses tax-free.

The key is planning early by regularly putting money in health savings pots. You can start small if needed and build up over time. Let tax relief make funds grow faster. You use discipline today to cover what the NHS may not provide tomorrow.

Staying Healthy to Reduce Costs

Your daily health habits make a huge difference when you are older. Small steps today can lower medical bills tomorrow. Saving money starts with caring for your body.

Eating fruits, vegetables, and whole grains fuels you well. Hydrating often keeps all systems working. Regular exercise drops future disease risks. And enough sleep each night fortifies daily activities.

You must see your GP once a year to catch any issues early. Report new pains and changes. You listen when your doctor says to improve nutrition, get more active physically, or see a specialist.

Get recommended health screenings:

- Blood pressure and cholesterol – help prevent stroke, heart disease

- Colonoscopies – detect cancer risks early

- Bone density scans for women – diagnose osteoporosis before fractures

- Memory tests – rule out early dementia to prompt treatment

- Hearing & vision checks to aid communication and reduce falls

Small lifestyle adjustments in your 40s, 50s, and 60s keep you more independent in your 70s, 80s and beyond. The NHS provides many preventative services to use. Staying fit both mentally and physically will benefit you for decades to come.

Seeking Professional Advice

Planning future health costs yourself can feel confusing. Seeking expert guidance tailored to your situation makes sense. Financial and care advisors clarify the best paths for your security.

A retirement planning financial advisor looks at your whole picture – income sources, living costs and savings. They suggest ways to invest, save or allocate funds to cover predicted medical expenses when older. An advisor calms worries by mapping personalised strategies.

Specialised health consultants also assist retirees. They detail public and private services that suit your conditions and support needs. Advisors explain health accounts, insurance options and benefit programs as laws change. Knowing you have a caring professional to call when needs change is comforting.

You can also get a pound 3,000 loan for bad credit from a direct lender in the UK. You can use these for large occasional costs like dental implants or new hearing aids if funds run short. You compare loan rates and fees first to find the best fit. Then, use loans judiciously only for important one-time expenses.

Conclusion

Caring for your body today means fewer medical worries tomorrow. Making small, healthy lifestyle steps has now paid off for decades. You build up savings to afford extra assistance as you need it more.

Don’t delay planning as costs increase yearly. Record predictions and look into types of policies and facilities available. Be organised through each phase of ageing. Protect assets and manage risks wisely at every new stage of changing health situations.

The road ahead seems clearer if you are ready to save for diverse health needs. You protect your abilities to remain active and engaged by accounting for how much independence will cost.